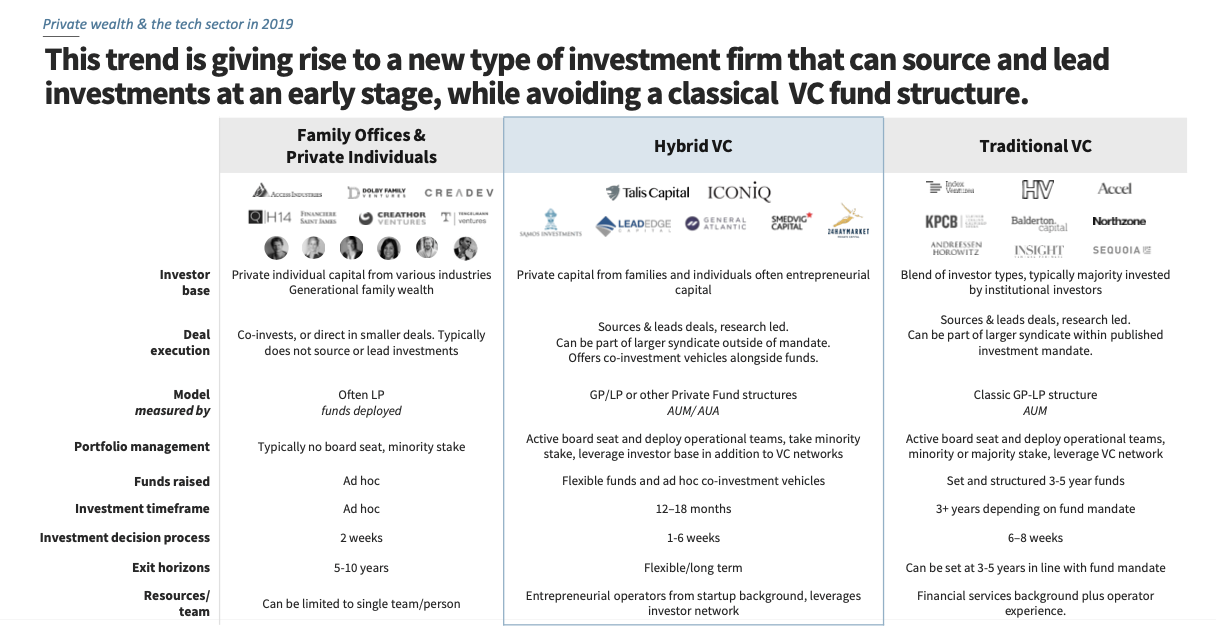

Matus Maar, co-founder and managing partner at Talis Capital, said: “We are seeing many more investors wanting to invest in tech and data driven businesses at an earlier stage. In part, this is to do with a new generation of ultra wealthy individuals and families who made their money through tech and want to keep investing in the sector. Great returns are also encouraging more investors to diversify into venture capital but finding the right tech deals to invest in is very difficult, if you do not have a track record, the networks or the know-how to execute it.”

Talis Capital’s network of investors and experts follow evolving macro technology trends and monitor how industries are changing to both source and lead new startup investments at the early stage, and to help these companies achieve their potential. As a result, they only accept private capital, which means they have no institutional investors and are not bound by institutional capital restrictions.

“Originally we were born out of a single family office and over the past ten years we’ve been on a journey which has led us to evolve into a fully fledged VC,” added Vasile Foca, co-founder and managing partner at Talis Capital. “Having a private-only investor base has been very strategic for us and the way in which we’re structured and how we operate has really come out of the ways in which our investors like to work – we now invest on behalf of a group of over 30 LPs.”

Since 2009, Talis has invested more than $600m worth of transactions and its portfolio of nearly 50 companies includes Darktrace, iwoca, Onfido, Ynsect, Luminance, Pirate Studios and Oh My Green.

“We predict venture capital and early stage tech investing will only become more popular with the world’s wealthiest, especially as the younger generation are persuading their previous generations that this is where they should be investing,” Maar continues. “They want to create strong legacy investments and work with exciting smart startups that can improve our world for the better in areas like health technology, sustainable farming and food production, mobility and climate change.”

Giles Heseltine, MD, Hottinger Private Office, said: “Our appetite for investing in venture stage tech has changed significantly over the past decade, boosted by the fact that there is a much better understanding of the sector, not to mention the increasing number of opportunities emerging at this stage.”

Christina Gaw, Managing Principal and Head of Capital Markets at Hong Kong-based Gaw Capital said: “The largest benefit we’ve seen from investing in VC funds is diversification. We can invest in emerging sectors, early-stage deals, and even into sectors and localities we’ve never invested in before with a confidence that only comes by leveraging the expertise, networks and relationships offered by hybrid VCs such as Talis Capital. ”

Mark Richardson, philanthropist and investor, said: “Largely our increased appetite for VC fund investing is due to better returns compared to other more traditional asset classes as well as our growing interest and involvement in the sector through Talis Capital as well as other VC funds. Investing via funds complements our own skills, knowledge and expertise in investing and we believe supporting the next-generation of entrepreneurs is a real responsibility. Our attention is drawn to investing in start-ups that disrupt traditional ways of doing things as well as those associated with sustainability and climate change. We take great pride in having the access and opportunity to invest in this new wave of founders and believe our allocation in this area will continue to increase”

-Ends –

Notes to the editor

Link to the Private wealth & the tech sector in 2019 research deck here

Contact:

Antonella Scimemi – antonella@burlington.cc / 07530 815 018

About Talis Capital

Talis Capital is a venture capital investment firm that takes smart money from some of the world’s most successful entrepreneurs and business people and invests it strategically in early-stage technology companies with global potential. Talis has invested over $600 million worth of transactions since 2009 and the portfolio includes Darktrace, Onfido, iwoca, Pirate Studios, Luminance, Threads, Ynsect and Oh My Green. Focused on building long-term partnerships, Talis leverages its network to give some of the world’s most innovative startups the opportunity to thrive. For more, see www.taliscapital.com.

Talis Capital Limited (“Talis”) is an appointed representative of Privium Fund Management (UK) Limited (“Privium”). Privium is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”). The investment services of Talis are only available to professional clients and eligible counterparties for the purposes of the FCA’s rules. They are not available to retail clients. Past performance is not a guide to future performance and any capital invested is at risk.